|

Title |

|

|---|---|

| Sunsetting of Bush-Era Tax Cuts |

More election year uncertainty: 2012 began with the fate of the “Bush-era tax cuts” unsettled, and no resolution appears in sight. Rather than just waiting for Congress to act, you should consider implementing certain protective tax strategies now. To maximize benefits, advance planning that considers a number of “what ifs” should be undertaken soon. With budget pressures looming, the likelihood that EGTRRA< and JGTRRA< expiring provisions will be rolled over for one or two more years into 2013 and 2014 is highly unlikely. Therefore, a strategy that accelerates into 2012 whatever tax benefits are currently available deserves careful consideration. |

| State Corporate Filing Websites |

Typically corporations are required to file annual reports, most of which can be easily filed online. We hope that the following list will be helpful, please contact us< if you need any assistance. We have marked the most common states. |

| Small Business Accounting & Profit Management |

By letting us handle your accounting needs, you can be assured that things will be handled correctly and that our advice can help you maximize your profit and growth. |

| Simplify Your Accounting By Avoiding the End of the Month |

One of the simplest, but effective accounting tips: avoid writing checks during the last few business days of the month.It will cut down on transactions that straddle two periods, and quicken bank reconciliations. |

| Should I use Quicken for my Small Business Accounting? |

Short answer: No. Long answer: Nope. Why: a) From an accounting and legal perspective you should not be commingling funds. Quicken can encourage a user to do just that. b) Quicken is not designed or supported in the same way that QuickBooks is. Unfortunately, we are often faced with problems opening and working with both Quicken and QuickBooks files, the difference lies the solutions available to us. |

| Separate Credit Cards for Separate Things |

Credit cards are much easier to track than cash, but never mix your personal with your business cards. |

| Sending us your Windows QuickBooks File |

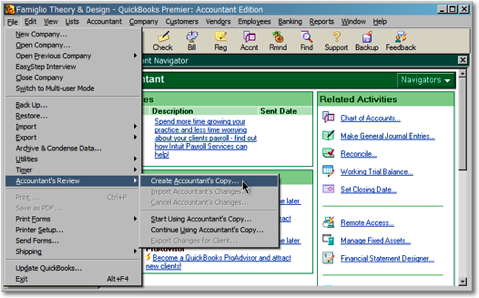

There are many several different ways for us to get your QuickBooks data, but the most efficient is to send us the Accountant's Copy. Most Windows versions of QuickBooks have the same or a similar process. Step 1:<From the file menu select Create Accountant's Copy...

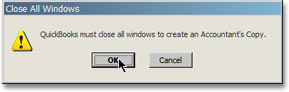

Step 2:<Allow QuickBooks to close all your open windows, by clicking OK.

|

| Sarasota's Real Estate Market & The Tax Benefits of Home Ownership |

Buying a home is the single most valuable investment many families make, and home ownership offers tax breaks that make it the foundation for your overall tax planning. The gulf coast of Florida's real estate market (specifically Sarasota's, Bradenton's, North Port's, & Venice's markets) was hit hard with some strong correction after the bubble. As a CPA Firm in Sarasota, Florida, we have been helping our clients deal with the effects, but also have seen improvements as home values have increased. If you are undecided as to a purchase or sale, it is important to know that the tax law provides numerous incentives to home ownership, including the following: |

| Safe Harbor for Shared Employer Responsibility Provisions |

The IRS has issued guidance for safe harbor methods that employers may use (but are not required to use) to determine which employees are treated as full-time employees for purposes of the shared employer responsibility provisions of Patient Protection and Affordable Care Act (PPACA<). |

George V. Famiglio, Jr, CPA/PFS, CFP, CFS, CGMA. Est. 1971

George V. Famiglio, Jr, CPA/PFS, CFP, CFS, CGMA. Est. 1971

<

< <

<