|

Title |

|

|---|---|

| Health Insurance Premium Assistance Credit |

Beginning in 2014, a penalty will be imposed on certain individuals who fail to have minimum essential health insurance for themselves and their dependents. However, to help subsidize the cost of health insurance and make it more affordable, eligible individuals who purchase coverage under a qualified health plan through an Affordable Insurance Exchange may receive a premium assistance credit. The IRS has issued guidance for employees on their eligibility to claim this credit. In order to be eligible for the premium assistance credit, a taxpayer must satisfy the following criteria: |

| Home Office Worksheet |

Fill out this worksheet if you are seeking deductions for your qualified home office. Accurate square footage numbers can be found on your local property appraiser's website. |

| How Can I See My Refund Status? |

The IRS provides an online tool to help you find the status quickly: |

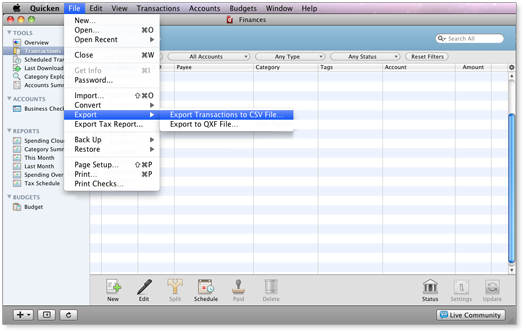

| How Can I Send My Mac Quicken File to My Accountant? |

While we recommend QuickBooks over Quicken to track your business, we have a procedure you should follow when sending us your Mac's Quicken File.

Step 1 - View Your Quicken Transactions<Open your Mac Quicken File, and click on the "Transactions" menu item on the left of the window under the TOOLS group. You should see a list of transactions on the right, and close to the top of that same window, a list of filters and a "Reset Filters" button. Click on the "Reset Filters" button, and then choose an appropriate date range from the left most filter. If your not sure select "All Dates". |

| How Do I Export My QuickBooks or Quicken File? |

We have guides available to walk you through the process: Mac OS X QuickBooks Export< Quicken is another beast entirely, and quite frankly small businesses should skip it and move directly to QuickBooks. That said, for those of you who haven't migrated yet, its better not to send us a backup file – instead contact us and we'll walk you through it. If you have a Mac version of Quicken, see this guide: If you need any more help just let us know. |

| How Long Do We Need To Keep Our Files? |

We have typed up a recommended list for your reference: Records Retention< |

| How to Maximize Tax Deductions |

Successful tax planning includes a review of your available deductions and the impact of your filing status on your option to itemize. It is important that all of the technical requirements for your deductions are met. In addition, certain items are deductible only to the extent they exceed a percentage threshold. By reducing your adjusted gross income, you increase the amount of itemized deductions you can claim, because the floor limitation amounts are reduced accordingly. A strategy commonly used in year-end individual tax planning is to determine the best timing for claiming itemized deductions. Generally, it is beneficial for taxpayers to defer income and accelerate expenses. This strategy may enable you to itemize your deductions if you claimed the standard deduction in the past. |

George V. Famiglio, Jr, CPA/PFS, CFP, CFS, CGMA. Est. 1971

George V. Famiglio, Jr, CPA/PFS, CFP, CFS, CGMA. Est. 1971

<

< <

<